An Advance is a personal loan your company makes to your client.

Example: A client books a job but is Station 12 and owes union dues. Your company loans the client the money for their dues and will re-coup it when the client gets paid for the job.

*NOTE The advance is ALWAYS paid out of your operating account NEVER through the client trust.

Step 1

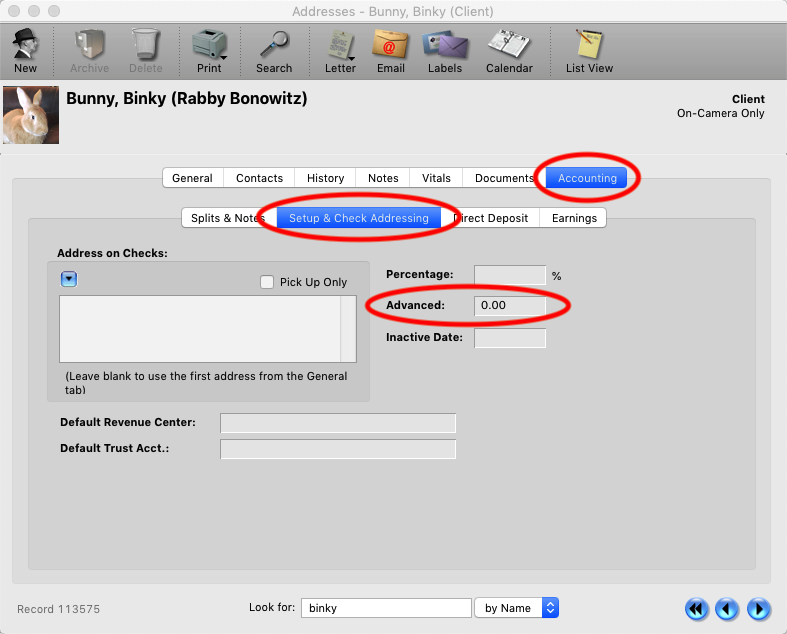

To record the Advance, go to the client’s address record > Accounting tab > Setup and Check Addressing sub tab. Click the gray box next to “Advanced:”.

Step 2

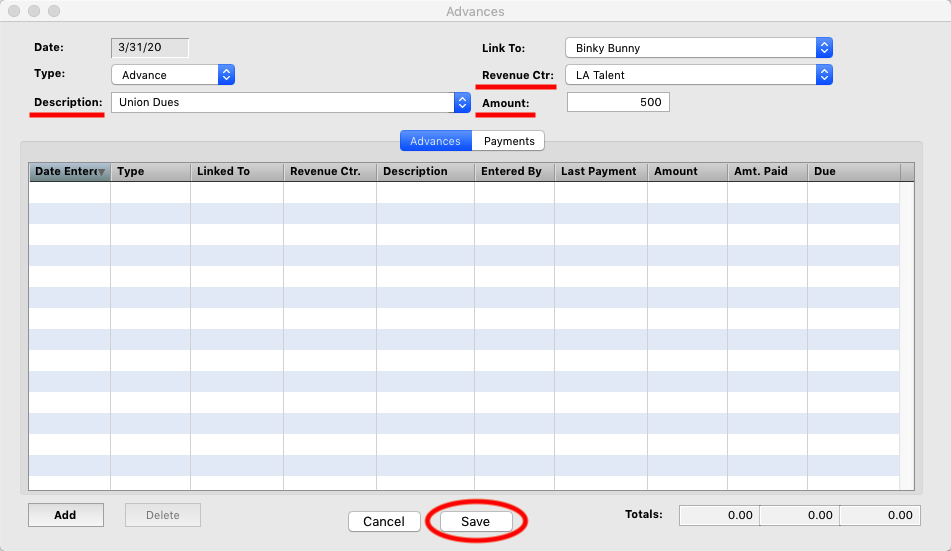

Enter a Description what the advance was for, which Revenue Center is loaning the client the money and the Amount. Then click Add and Save.

Step 3

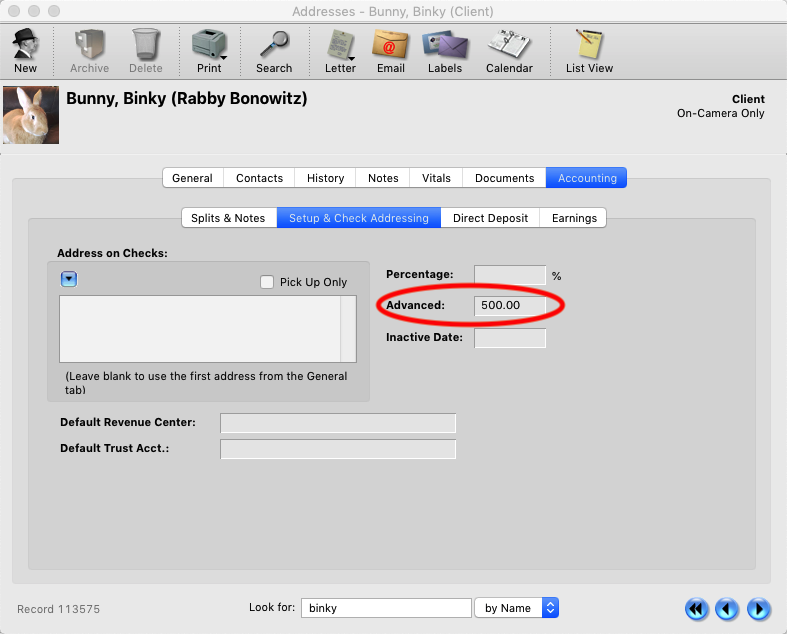

The current amount the client owes is then displayed in the Advanced box. You can click the gray box to see the details of the advances and payments made against them.

Step 4

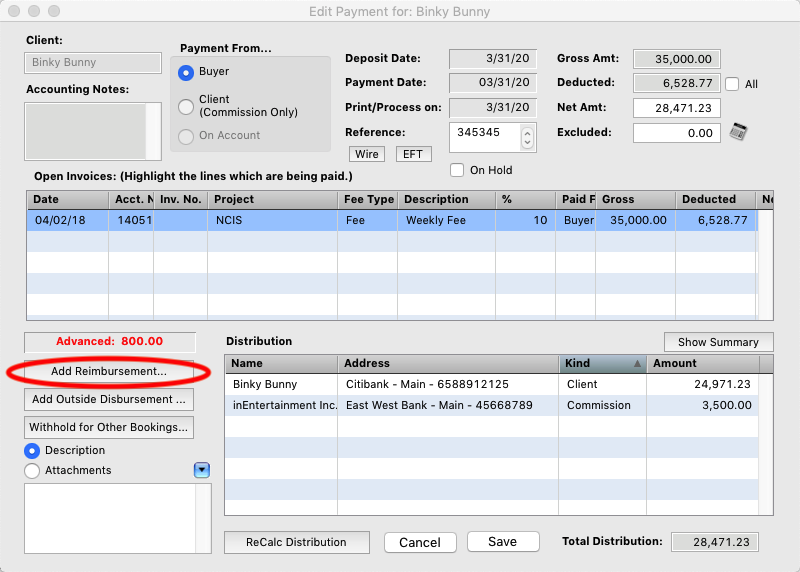

When you are entering a payment for client with an outstanding advance, the amount owed is displayed on the left side of the payment entry window. To add a reimbursement for your company click the “Add Reimbursement” button.

Step 5

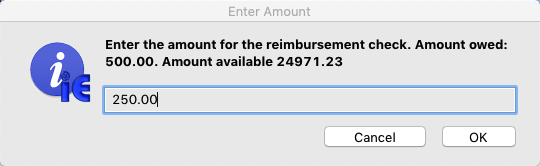

Enter the amount you wish to take from the client’s current disbursement.

*NOTE You do not have to take the total amount owed. You can agree to a payment plan with the client to pay it off in installments if necessary.

Step 6

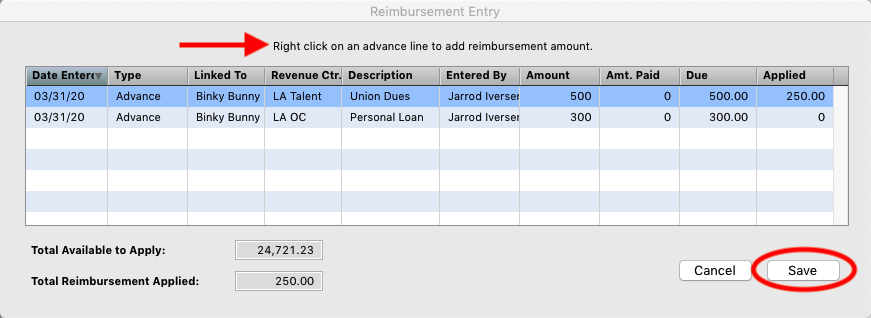

If the client has multiple advances you will be prompted to pick which one to apply the reimbursement against. R-Click in the Applied Column to set the amount. Click Save when done.

Step 7

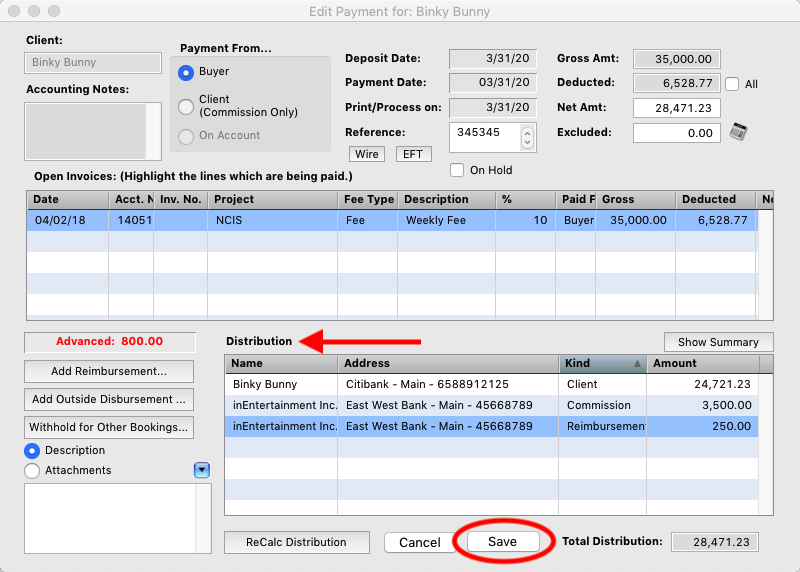

In the disbursements area you will the see the reimbursement to your company. Click Save.

Step 8

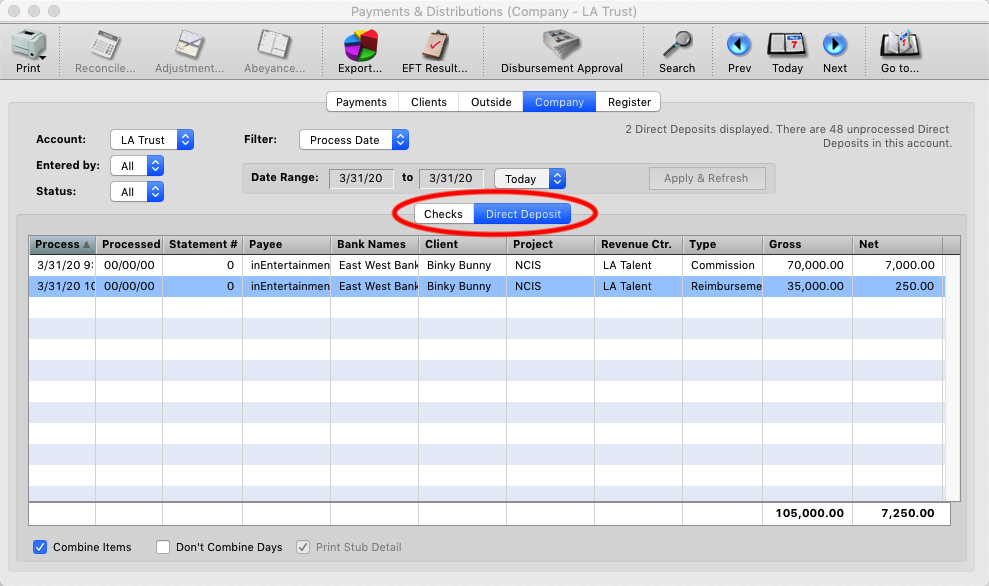

In the Company payments Checks or Direct Deposits queue, reimbursements are always paid out on a separate line as they are not part of your regular commissions for the day.